AI-Driven GRC TransformationIn today’s fast-paced business world, staying compliant while managing risks feels like walking a tightrope. I remember a time when our team would spend hours poring over regulatory updates and ensuring everything aligned perfectly with the rules. Despite their hard work, the sheer volume of information often left gaps that no human effort could fully bridge. It can be overwhelming, right?

This is where Artificial Intelligence steps in—not as a replacement for our dedicated teams but as a transformative partner. Imagine AI not just automating tasks, but enhancing decision-making, predicting risks, and simplifying compliance processes in ways we never thought possible. With regulations changing faster than ever, integrating AI into Governance, Risk, and Compliance is becoming essential—like having a trusted advisor in your corner.

This blog delves into why AI is crucial for GRC, the key technologies driving its adoption, practical applications, and the road ahead for businesses ready to embrace this evolution.

The Problem: Why Traditional GRC Falls Short

Regulatory Complexity

Organizations face an increasingly intricate web of regulations that continuously evolve. Take, for instance, the Goods and Services Tax (GST) changes in India; these can overwhelm businesses trying to stay compliant. The challenge of keeping up with regulatory shifts across different jurisdictions is not only daunting but also a significant source of stress for compliance teams.

Data Overload

Adding to the complexity is the sheer volume of data that organizations must navigate. Today’s businesses are inundated with massive amounts of both structured and unstructured data. Manually sifting through this information to extract relevant insights can feel like searching for a needle in a haystack. This data overload not only complicates compliance efforts but also hampers decision-making processes, leaving organizations vulnerable to oversights.

Reactive Approach

Another critical limitation of traditional Governance, Risk, and Compliance (GRC) frameworks is their reactive nature. Often, these systems respond to issues only after they have arisen, resulting in costly delays and potential fallout. This can lead to significant financial implications and damage to an organization’s reputation, making it imperative to adopt a more proactive strategy.

The Solution: AI-Driven GRC Transformation

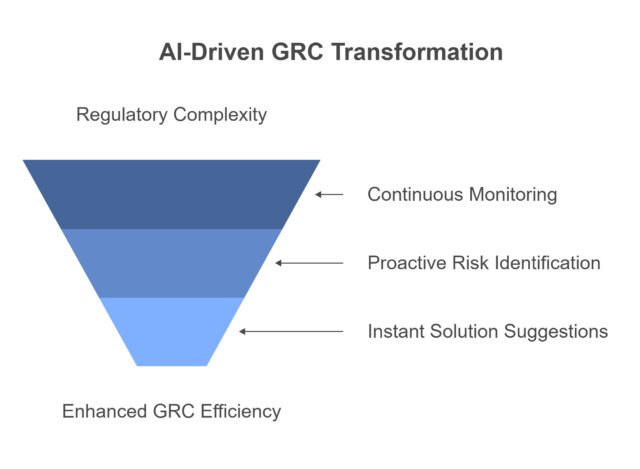

Fortunately, AI redefining how organizations approach GRC, transforming it into a dynamic and predictive process. Imagine having a digital assistant that revolutionizes your compliance efforts by:

-

Continuous Monitoring: This AI-powered assistant can monitor and interpret regulations 24/7, ensuring that your organization is always informed of the latest changes and requirements.

-

Proactive Risk Identification: It can identify potential risks before they occur, allowing organizations to mitigate threats before they escalate into serious issues.

-

Instant Solution Suggestions: By harnessing the power of AI, this digital assistant can suggest solutions faster than a human could brainstorm, enabling teams to make informed decisions quickly and efficiently.

The Growing Importance of AI in GRC

The convergence of AI and GRC addresses three key challenges modern organizations face:

- Regulatory Complexity

Regulations can feel like a maze. Governments and industry bodies worldwide are constantly revising laws, particularly in areas like data privacy, cybersecurity, and environmental sustainability. Keeping up is a daunting task for GRC teams. AI helps decode these changes, providing real-time insights and ensuring businesses remain compliant. - Data Overload

Organizations generate and handle vast amounts of structured and unstructured data daily, and let’s be honest—traditional systems struggle to analyze this information effectively, leaving room for oversight. AI excels at processing large datasets, identifying patterns, and pinpointing risks or compliance issues quickly and accurately. - Proactive Risk Management

Unlike traditional approaches that respond to issues after they occur, AI enables a proactive stance. By leveraging predictive analytics, AI identifies potential vulnerabilities early, helping organizations act before risks can escalate.

Technologies Powering AI-Driven GRC

The transformative potential of AI in GRC stems from a suite of technologies designed to address specific challenges:

- Machine Learning (ML): ML algorithms analyze historical data to predict risks, detect anomalies, and refine GRC strategies over time. For instance, they can identify unusual transaction patterns that may indicate fraud, acting like a detective in your organization.

- Natural Language Processing (NLP): NLP processes complex regulatory documents. It can extract key clauses and convert them into actionable tasks, streamlining compliance efforts across various jurisdictions—almost like having a translator for legal jargon!

- Robotic Process Automation (RPA): RPA automates repetitive tasks, such as audit preparations. Reducing errors and freeing up time, it allows compliance teams to focus on more strategic responsibilities.

- AI-Powered Dashboards: Interactive dashboards consolidate GRC metrics in real-time, offering decision-makers clear and actionable insights at a glance.

How AI is Transforming GRC

Artificial Intelligence doesn’t replace human efforts—it amplifies them. Let’s break the AI-powered GRC workflow into easy-to-understand steps:

1. Regulatory Monitoring and Intelligence

The Challenge:

Regulatory environments constantly evolve, with frequent updates and new requirements that overwhelm organizations. Traditional methods for tracking these changes tend to be time-consuming and vulnerable to inaccuracies, complicating compliance efforts.

AI’s Role:

AI technologies leverage Natural Language Processing (NLP) to analyze dense legal documents efficiently, extracting pertinent clauses and translating them into actionable tasks. Furthermore, AI facilitates continuous monitoring of regulatory updates, providing organizations with timely information to remain compliant.

Impact:

Implementing AI for regulatory monitoring delivers real-time updates on changes, significantly lightening the workload for compliance teams. This allows teams to redirect their efforts toward more strategic initiatives, enhancing overall operational effectiveness.

2. Risk Identification and Management

The Challenge:

Manual risk assessment processes are frequently slow and reactive, limiting an organization’s ability to identify emerging risks before they escalate. Such approaches may overlook critical signals, leading to vulnerabilities.

AI’s Role:

AI introduces predictive analytics to examine historical and current data, enabling the anticipation of risks. Anomaly detection systems recognize unusual patterns in transactions or system behaviors, while dynamic risk scoring adjusts risk levels in real time as new information becomes available.

Impact:

The integration of AI in risk management empowers organizations to adopt a proactive stance against potential threats. This shift improves accuracy and minimizes the oversight commonly associated with manual assessment methods.

3. Compliance Automation

The Challenge:

Compliance procedures in larger organizations often demand extensive manual intervention, creating inefficiencies and increasing the risk of human error.

AI’s Role:

Robotic Process Automation (RPA) plays a crucial role in handling routine compliance tasks such as updating policies and maintaining records. Digital assistants also support employees by offering real-time guidance on compliance protocols and addressing frequent queries quickly.

Impact:

By automating compliance processes, AI enhances operational efficiency and reduces the likelihood of errors. This allows compliance teams to concentrate on higher-value activities, such as strategic planning and risk assessment.

4. Incident Management and Response

The Challenge:

Incidents like data breaches or compliance failures necessitate rapid responses, but delayed actions can worsen the aftermath, leading to greater damage.

AI’s Role:

AI facilitates swift root cause analysis to identify the origin of incidents accurately. It also provides remediation recommendations and generates automated reports for both internal and regulatory assessments.

Impact:

Utilizing AI in incident management minimizes downtime and accelerates recovery, ultimately bolstering the organization’s resilience against future risks.

5. Audit and Reporting Simplification

The Challenge:

The preparation of audit reports is traditionally labor-intensive, requiring considerable manual effort for data collection and verification.

AI’s Role:

AI streamlines this process by offering real-time dashboards that consolidate relevant data into intuitive formats and enables automated report generation, reducing the need for manual oversight. AI also conducts thorough audit trail analyses to ensure transparency and accountability in compliance practices.

Impact:

These advancements significantly streamline audit preparation, conserving both time and resources while enhancing the accuracy and consistency of compliance reporting.

6. Fraud Detection and Prevention

The Challenge:

Fraudulent activities are becoming increasingly sophisticated, often evolving quicker than traditional detection methods can adapt.

AI’s Role:

AI employs behavioral analytics to spot deviations from expected behaviors, flagging potential fraud. Additionally, it provides real-time alerts on suspicious activities, empowering organizations to respond promptly.

Impact:

By employing AI for fraud detection, organizations bolster their security measures, enabling quicker identification and resolution of fraudulent activities, thereby mitigating financial and reputational risks.

7. Policy Management and Enforcement

The Challenge:

In large organizations, enforcing updated policies consistently across all departments can be a complex task.

AI’s Role:

AI helps by translating complex regulations into clear, actionable policies that cater to the organization’s specific needs. It also monitors compliance with these policies, ensuring alignment with the latest requirements.

Impact:

This approach improves consistency in policy enforcement across the organization, significantly lowering the risk of unintended non-compliance and enhancing overall governance practices.

Challenges in AI-Driven GRC Adoption

Implementing AI in Governance, Risk, and Compliance (GRC) offers numerous advantages, but organizations must navigate several challenges that can hinder success.

Trust and Transparency

One major concern is trust in AI systems. Many organizations are apprehensive about AI’s “black-box” nature, where the decision-making process is not always transparent. To alleviate these concerns, it is essential to develop explainable AI models that provide insights into how decisions are made.

Data Privacy Data privacy is another critical challenge. AI relies on large dataset, often containing sensitive information, organizations need to ensure compliance with data protection regulations such as the GDPR, to manage personal data responsibly while leveraging AI technology.

Implementation Costs

While AI can lead to significant long-term savings, the initial implementation costs can be considerable. Investments in AI tools, infrastructure, and employee training represent a significant upfront expense, which may deter some organizations from adopting these technologies.

Skill Gaps

The effectiveness of AI systems also depends on the skills of the workforce. Many organizations encounter skill gaps in AI management, necessitating additional investments in training existing employees or hiring specialized staff. This step can create logistical challenges during the transition.

Despite these hurdles, the advantages of adopting AI for GRC processes can be substantial.

Enhanced Decision-Making

AI provide data-driven insights that empower leaders to make informed strategic decisions rather than relying solely on intuition. This clarity can lead to more effective governance and risk management.

Scalability

AI systems are highly scalable, enabling organizations to handle complex global operations. They can adapt to various regulatory frameworks and organizational structures without compromising efficiency.

Proactive Risk Mitigation

One of the standout benefits of AI is its ability to predict potential risks before they arise. Organizations can avoid costly incidents and protect their reputations by identifying vulnerabilities early.

Cost and Time Savings

Finally, AI can significantly reduce costs and save time by automating labor-intensive tasks such as audits and compliance tracking. This allows teams to focus on higher-value activities that drive growth and innovation.

Conclusion

AI in Governance, Risk, and Compliance represents more than a technological upgrade—it’s a transformation in how organizations approach these critical functions. By automating routine tasks, predicting risks, and delivering actionable insights, AI shifts GRC management from reactive to proactive, enabling businesses to stay ahead in an ever-evolving regulatory landscape.

As the complexities of compliance and risk management grow, the decision to adopt AI is no longer optional; it’s a strategic necessity. Organizations that embrace this evolution will enhance their operational efficiency and safeguard their reputation and position themselves for sustained growth in a competitive market.

The future of GRC is one of intelligence, adaptability, and resilience. With AI as a trusted partner, businesses can leave behind outdated spreadsheets and siloed systems, embracing a smarter and more integrated approach to governance and risk. Now is the time to act—AI is not just a tool but a cornerstone of the future of compliance.